Is the Government Really “Running out of Money”?

October 15, 2021

The short answer? Yes. Due to a partisan conflict in Congress, the United States government is coming nearer and nearer to default on its national debt this December, a situation in which the government will “run out of money”, and be unable to cough up the cash it owes in expenses.

But first, how does our government end up in debt in the first place?

The simple answer is that the United States government spends more than it actually has. This is called the budget deficit. In order to pay for the excess, the government needs to borrow money from the Treasury. The government will then use the borrowed money to pay for whatever expenses it cannot pay for with its own revenue. The amount of borrowed money that the United States needs to pay back is known as the National Debt.

Because the United States government rarely has a “budget surplus” (when government revenue will exceed the amount the government spends) it continuously accumulates debt to pay for its expenses. However, there is a limit to how much debt the United States government can be in at a time. This is called the debt ceiling.

The debt ceiling, however, has not actually limited government debt. Instead, it is routinely increased when the limit is approached in what has historically been a bipartisan (this means both Democrats and Republicans are in agreement) vote. Most recently, however, Republicans and Democrats have turned it into a partisan issue, with both sides using the raising of the debt ceiling as leverage.

This is what has led to the current crisis in Congress, in which Republicans have refused to participate in legislation to raise the debt ceiling along partisan lines. Senate Minority Leader Mitch McConnell said, “Republicans’ position is simple. We have no list of demands. For two and a half months, we have simply warned that since your party wishes to govern alone, it must handle the debt limit alone as well.”

If the government cannot raise the debt ceiling by the time the bills are due, then they risk a default. They will not be able to borrow more money to pay for the expenses they’ve racked up in the previous years, hence, they have “run out of money”. What does it mean for the rest of us if the government does “run out of money” (default)? Many economists spell doom.

Without borrowed money, the government will be unable to pay for a significant amount of social programs, most notably, Social Security and Medicare. The government would also be unable to pay interest payments to bondholders (people they are in debt to via bonds). Unemployment can double. Some say this would throw the United States into another recession.

The loudest doomsayers are even more fearful. They say that if the government defaults, faith in American bonds (a type of financial security issued by the Treasury, which is bought by bondholders, with the knowledge that the United States government will pay them back), once thought to be the safest in the world, would waiver. The value of the United States dollar could collapse, causing inflation. The world could abandon the United States dollar as the “default unit” of the global economy, and America would be unable to afford the current standard of living it enjoys now.

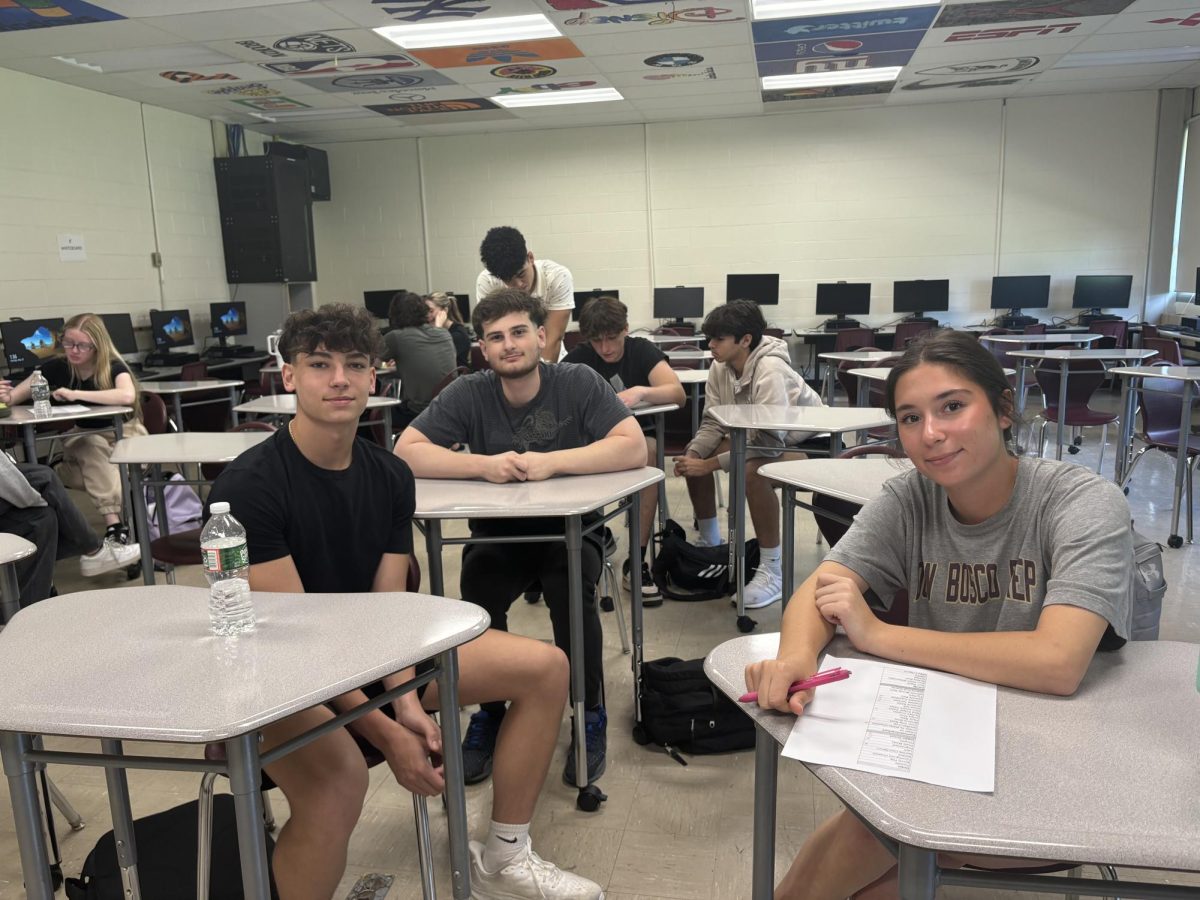

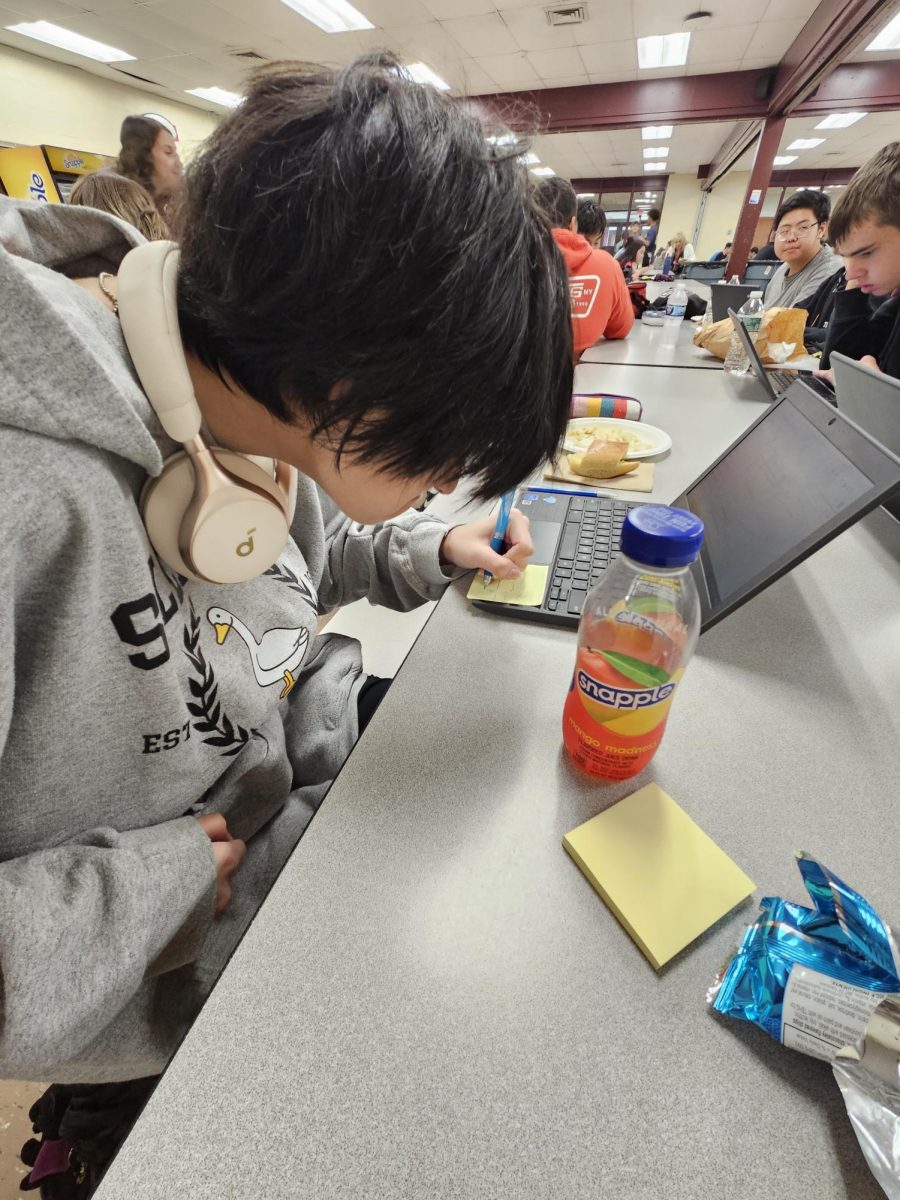

Wayne Hills students weighed in on the topic.

“The consequences of this sound really scary,” says Alexandra Annicaro, a senior at Wayne Hills, “I don’t understand why [Congress] isn’t trying harder to find a [bipartisan] solution.”

The current debt ceiling has been temporarily raised until December when another deadline on default will appear and Congress will once again have to vote on whether to raise the ceiling. Political commentators anticipate another crisis in December. Mitch McConnell, Minority Leader, has said the Republicans will not vote on any future measure to raise the debt ceiling, and that Democrats will have to find a way to do it themselves. Democrats in Congress, however, demand Republican cooperation.

Other members of government offer more creative solutions to bypass partisan warfare and pay the bills. One of the most humorous comes from the Treasury, where senior officials have previously suggested, “Having the president mint a $1,000,000,000,000 dollar commemorative coin and then cash it at the United States Treasury.”